Case Study – How Stratus continues to drive Value and Improvement with its Clients for Regulatory Services

By Meyvannan Varadharajan & Garima Goel

What are Late Reported Claims?

Adjusters creating claims on already expired/closed WC policy periods are termed as Late Reported Claims.

Problem Statement:

The Late Reported Claims which are created on a closed or expired WC policy period with no prior claim in open status for that particular policy period are not being reported to WCIRB bringing regulatory incompliance. In these situations, WCIRB expects the claims to be reported and filed with the Bureau via WCSTAT Report.

Since the automated WCSTAT batch is unable to pick up these Late Reported Claims for reporting, this has been causing manual work for the team to prepare correction files so that the Late Reported Claims could be submitted to WCIRB on time avoiding incompliances.

Proposed Solution:

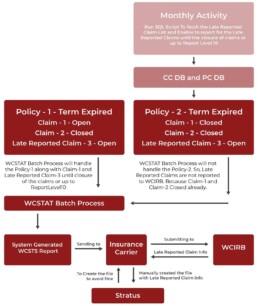

After detailed root cause analysis and investigation, we designed Script 1 to identify the LRCs every month. Followed by running Script 2 to update the “Flag Variable” and Report Level for the closed Policy period where the Late Reported Claim has been filed. This process of Script runs will take care of reporting the late reported claims every year until its closure or up to 10th Report Level to WCIRB.

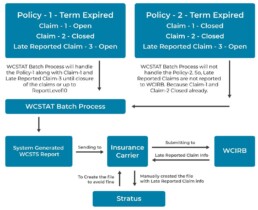

Understanding As-Is Architecture/Flow:

Understanding Proposed Architecture/Flow:

#ValueLeap – Business Value Delivered

- All claims logged in the GW system are getting reported to WCIRB via WCSTAT files without failure.

- Ensuring Regulatory Compliance.

- Avoiding manual work of preparing correction files to report LRCs.

- Reducing the Insurance Carrier’s error count in the Quarterly Business Review with the Bureau.

- Delivering Happy Client!

Meet the Authors