Thought Leadership: Exploring Future of Drones in Insurance Industry

By Lavanya Ramani

Drones are more formally known as unmanned aerial vehicles (UAVs). Essentially, a drone is a flying robot that can be remotely controlled or fly autonomously through software-controlled embedded systems, working in conjunction with onboard sensors and GPS. The bird’s eye view offered by drones enables businesses to capture detailed photographs and videos from the sky. This visual data, when analyzed and interpreted, helps businesses to gain intelligence that can be used to make informed decisions. Drone usage within the insurance industry is on the rise. They are used to take photos and capture other data to inform insurance risk assessments and claims. What was once seen as cutting edge is quickly becoming a mainstream technology, especially given the current global pandemic situation.

How are Insurers Using Drones or May Use Drones?

Deploying drones for insurance inspections – When a disaster hits, damages must be assessed swiftly to ensure timely payouts to the insureds. However, accessing the disaster area may be dangerous for adjusters. Even when the situation stabilizes, civil authorities may still pose restrictions to enter the areas. This leads to placing thousands of claims on hold, resulting in business downtime, and increasing dissatisfaction among customers. Drones can enter premises and zoom in on affected areas, capturing first-hand data without disturbing/tampering the scene. Humans can remain at a safe distance and review the transmitted video and photos in real time to assess the impact. And with advanced Geographic information system (GIS) if the weather conditions worsen, the UAV can return safely and notify on-ground personnel.

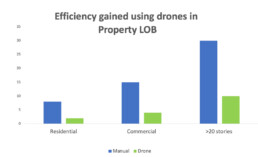

Accelerating claim adjudication – Insurers are still relegated to getting property and other details through outdated inspection processes that involves drive-by inspections, manually inspecting roofs, or renting expensive machinery like cherry pickers to assess high-rise and multi-level structures. This might result in inefficient data gathering. Insurance companies should start enabling efficient techniques to remain competitive in the market Drones have become a necessary tool of the trade for claim adjusters, as it enables them with better decision-making and eliminate guesstimation. Auto insurers should also look into drones. Instead of having boots on the ground, adjusters can quickly dispatch a drone to investigate a claim filed by a customer. This can speed up claims settlement and improve the customer experience.

Risk monitoring – Drones for insurance claims can be dispatched to monitor disaster prone areas and gather data for giving more accurate quotes to customers. By partnering with government organization, insurance companies can also alert residents about risks and help them minimize losses. On a more granular level, drones equipped with infrared cameras have proven effective at detecting water and air leaks – which has been a complicated and time-consuming process for adjusters to identify it manually. This also boosts the efficiency of the staff by 40 to 50 percent.

Better data for analysis – Drones can equip insurance companies with better data for analysis. Gathering comprehensive first-hand data is crucial to determine fault indicator of an accident. Drones offer a safe and fast way of accessing damage. On-site information can be further enriched with additional location data –weather, road conditions, etc. – to create advanced site maps.

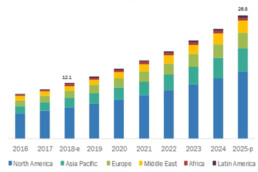

Region Forecast of Drone Usage

North America – North America was the pioneer in using drone technology, especially in insurance and it was the largest region in the drone insurance market in 2020 which also in one way or the other helped industries bounce back quickly.

Asia Pacific – Drones are still emerging in Asia-Pacific Region and is anticipated to have the highest growth during the Forecast Period.

Benefits of Using Drones for Insurers

Comprehensive Data – One of the most substantial factors that make drones unique is high-quality content acquisition. They can easily gather minute details of the location. When done manually, adjusters find it cumbersome to obtain evidences from all angles. Also, the acquired data is considered inefficient and inaccurate. On the other hand, drones collect comprehensive visual information about anything that is insured. This leads to dramatically faster claims processing, better efficacy, and higher profits.

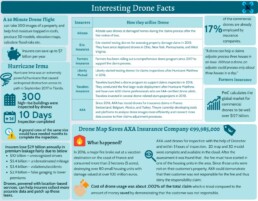

Better transaction processing – The employees shouldn’t put themselves at risk during hands-on inspections at properties, construction sites and other hazardous places. Also, the inspections shouldn’t take long. Insurance companies that use drones receive the information they need 10 times faster than those relying on traditional methods. The costs of gathering the information is also lower.

Inspection of Dangerous Areas – It is difficult for emergency responders to visit every affected area to collect the necessary information. Sometimes, reaching the affected place itself is a risky job. Drones can access dangerous areas during inspections, minimizing the risk of harm to the field officers. It can be termed as an insurance for the insurer.

Prevention of Fraudulent Activities – Providing inaccurate information intentionally to gain insurance benefits is a common concern that the insurance companies face. The insured can commit this illegal activity. With drones coming into picture, the chances of such fraudulent activities may be eliminated. Drones can collect and store the data on the cloud. Every department in the insurance company can view, monitor, and inspect the details, leaving no room for any illicit activities.

Augmented accuracy for decision making: Drones also enable adjusters to get very close to a roof, zoom in on questionable areas and analyze details to understand the cause of loss—all without disturbing the scene. This is beneficial when writing reports, as images and video gathered from insurance inspection drones can be easily integrated to present a fuller picture of any claim.

Drone and roof inspections – One of the major uses of drones in the insurance industry is roof inspections. Roofs are indeed the costly parts and insurance companies can only be ready to handle the problems after the damage is clear and easily visible through drones. The high costs of roof maintenance have impacted the budgets of the insurance companies as well. It is due to this reason; many companies avoid promising the damages of the roof if it is older than 20 years. Whenever the roof damages and the owner of the roof files the claim, the insurance industry assigns the roof inspectors who physically climb up the roofs and look for the damages. But nowadays, insurance companies are focusing more on the safety of the insurance inspectors and are oriented towards the use of drones. The best part about the use of drones is that they are helpful for the insurance companies and prevent them from any kind of fraudulent claims.

Identifying the Fraudulent Claim – The housekeeper may apply for insurance for the leaking roof even if it was leaking before the storm. With the help of the drones, the insurers can understand whether the leakage of the roof is due to the storms or not. It helps to eliminate false claims and disputes with customers who submit claims for existing damage.

Real Life Use Cases

Catastrophe

A reinsurance example is the Typhoon Goni catastrophe, where AIG (American international group) used a drone to ease the claims backlog. One of their clients was a factory owner, whose roof was leaking. It was too dangerous to send an inspector up to find the leak, so a drone was used instead.

Roof Inspections

In personal insurance, one of the riskiest and commonest activities that a claims assessor must engage in is roof inspections. This is a hazardous and time-consuming process. It can result in injury to the inspector and take hours navigating around the roof to get a full inspection done.

Using a drone radically reduces the time spent gathering the information, and the inspector does not even have to be on site, as a drone pilot can be sent out instead. An adjuster can triple the number of sites visited from 2 to 3 a day to up to 9 claims.

Business Value

Drones are a quantum leap in inspection technology, allowing insurers to capture images of properties that they could never access before. If insurers want to ensure the most accurate assessments and secure the revenues, drones are the only way to go.

Drones Fighting the Pandemic

In a novel coronavirus world, the benefits of using drones is being highlighted even further. Physical assessments are hampered by social distancing and isolation guidelines. Keeping human contact to a minimum has not only become important, but sometimes strictly necessary because of lockdowns or parties — loss adjusters, claims handlers or policyholders — self-isolating. This means that walking through a damaged property with a policyholder may no longer be feasible. 35% of firms in the insurance industry cited to be investing in drone technology, according to a survey conducted by the firm. At a time when many insurers have been badly hit by the pandemic, technology that has the potential to bring operational savings is likely to lure the industry.

Amid the COVID-19 crisis and the looming economic recession, the global drone insurance market is increased from $1.06 billion in 2020 to $1.13 billion in 2021 at a CAGR (Compound Annual Growth Rate) of 6.1%. Since gradually the commercial activities are resuming, the drone operation is also increased. The market is expected to reach $1.41 billion in 2025 at a CAGR of 5.9%. Due to relaxations from the governing bodies like FAA (Federal Aviation Administration) and EASA (The European Union Aviation Safety Agency), demand for drones have emerged in a lot of industries. Going by the trend and the pandemic situation, commercial drones are expected to register higher growth during the forecast period compared to consumer drones.

Challenges of Using Drones in the Insurance Industry

Adopting disruptive technologies of drones in insurance industry always carries a certain amount of regulatory and business risk. For drones to become part of business as usual, the insurance industry will have to address a few drone-related issues.

Aviation regulations – The current FAA rules allow commercial drones to stay in the air during the daytime. They can fly no higher than 400 feet above the ground at a maximum speed of 100 miles per hour and always must remain in the visual line of sight. They cannot fly within 9 kms. of an airport, heliport, or aerodrome. These limitations would restrict an insurer’s ability to use drones for large-scale inspections. But recent waivers now allow limited operations beyond visual line of sight. Due to global covid-19 pandemic, companies expect some progressive rulings for UAVs issued by regulators around the world.

Privacy – Trespassing and operating below navigable airspace can cause legal problems for insurers. Insurance companies must invest in developing rich navigational maps with real-time data to protect them against common-law nuisance claims. Also, insurers must seek permission from insured before conducting a risk assessment of their property. Failing to do so might cause legal trouble.

Casualties and liability – After the drone incident in 2018 at Gatwick airport, England, the public feels unsafe about using drones. Drone crashes, injuries, and casualties have been widely publicized. Therefore, insurers will have to carefully assess the potential damage drone inspections can cause and be prepared to address possible negligence and liability claims.

Corrupted technology – 63% of drone crashes occurs due to technological glitches and not human error. Loss of communication between a drone and the operator is the most common problem. To reduce these risks, the hardware and software must be carefully chosen with a partner who has in depth industry knowledge.

Data leakage and security – Sensitive data can be lost due to a crash or equipment malfunction. Drones, which transmit data in real time, are also exposed to cyber-attacks. The blockchain is one option for managing such sensitive data exchanges, securely transmitting data about a drone’s location, and proximity to restricted zones.

Future of Drones in the Insurance Industry

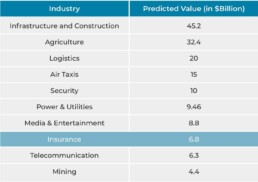

Below is the predicted value of industry sectors globally in 2030.

The insurance industry is very open to embracing new technologies. Drones are sure to rewrite the insurance industry’s standard operating procedures. Areas which insurance industries should try to focus are,

Technical maturity – Technologies play a vital role in the development of insurance companies, contributing to improving the product range and gaining competitive advantages. Drone technology is evolving fast, but many angles still need to be addressed, such as battery life which is still insufficient to perform long-haul flights. Multiple batteries are often required for flights over a large area under investigation.

Return on investments – More use cases are required to prove that drones are more than just a trendy toy. A cost-benefit analysis that shows potential ROI will help convince businesses to use drones in their operations. If a drone isn’t required for frequent use (e.g. only for an annual analysis), ‘drones as a service’ may be a more relevant way to introduce drones. When the human effort is no longer required and drones can fly autonomously and/or in combination with robotics, that’s where real disruption will come in and the use of drones will be faster, safer, more accurate and cheaper.

Market immaturity – Market immaturity is evident on the level of business models. Many insurers are still trying to identify where they’d like to be in the market and what to focus on. With no one-stop shop, industries must build their own knowledge of drones and be able to explain their needs and required drone specifications.

Early stage – Software is still at an early stage and there’s no off-the-shelf software available that fits the needs of most businesses, mainly because professional users want them for niche applications. Businesses are therefore required to develop their own software or at least actively participate in its development. More mature software packages will allow businesses to reach efficiencies, such as higher processing speed, intelligent recognition, and pre-analysis of irregularities.

Source –

https://medium.com/justez/the-future-of-drone-technology-and-insurance-e3965d1ecf1

http://riskandinsurance.com/rise-drones/

https://www.commercialuavnews.com/europe/value-european-drone-market

https://www.carriermanagement.com/news/2016/09/13/158783.html